Hi All,

As of this writing, EURUSD is trading just above $1. That represents a 13%-ish decline just from the start of the year. The ICE Dollar Index is above 108 and, unsurprisingly, is 13% higher than the start of the year (funny how that works when EUR is by far the largest part of the index). What’s different now?

Crude oil is having a dramatic move lower today and is almost at pre-Ukraine war levels; GSCI (overall commodity index) looks exactly the same

The yield curve (2s-10s) is 10bps inverted

Perma-dove Lael Brainerd wants 75 and Esther George makes her first ever dovish dissent

Eurodollar futures curves predicting a quick retreat from tightening into easing in less than a year

M2 (the money supply) declining, albeit slightly. To put this in perspective M2 growth has been “numba go up” for, idk, like 10 years

Emerging markets are stressed

I know that I did not mention the great jobs number. Why? Because non-farm payrolls are not a leading indicator. The market’s expectation is for 75bp move next meeting. Clearly things are breaking or close to breaking in multiple areas. It is far from clear based on the evidence that the Fed is strictly looking at this from the perspective of stability of the dollar (up 13% in 7 months!) or full employment (household survey is deviating from NFP number). To figure out the Fed’s move, consider that it may be working with Treasury as a foreign policy tool. Before you dismiss it, how different would that be than sanctions?

Although the headline to this story is “Crypto Startup Funding Falls to One Year Low”, I don’t feel that is the main theme one should take away from the actual data:

Honestly, that looks pretty strong considering. I’m guessing it falls further, but that still seems like a strong institutional commitment to crypto. Also, MakerDAO sets up $100M stablecoin vault for traditional bank.

Markets look like:

Basis more of the same with BTC & ETH sporting low yields and alt-coins negative

Put skew has subsided considerably (this week above last week):

Vol is lower and is under 30 day realized volatility

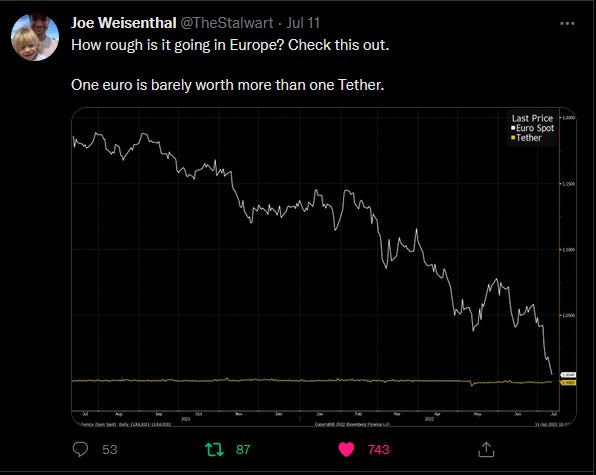

One thing I’m worried about: Tether. Honestly, it is not that I think things are worse for USDT. And I’m not predicting anything. Outstanding Tether (Tethers?) have fallen by 25%. From, roughly $80B to $60B. If there is a shortfall, then it is still there and it now represents a larger proportion of assets. Any withdrawal is getting 1:1 with USD. So that leaves everyone still in the pot with the same absolute dollar amount of badness but with fewer USDT to share the loss with. Again, I’m not predicting anything, just thinking about the math.

Good read / introduction to hedging & shorting:

From Don’t Get Squozen

Best

Ari