Hi All

When I was in high school, a friend of mine anticipated Seinfeld (yes, I’m that freakn old) and said, “Did you know that there is an acceptable amount of rat hair that can be found in cans of tuna fish?” Before you shun tuna fish, realize that, of course, the same goes for all foods — including vegan! Of course, all of us feel strongly the acceptable amount of rat hair in food is … zero. Yet the practical reality of life is that no matter how much we want things to be pure (literally with food), that there are compromises. This week in crypto and markets generally illustrated that well.

The US Dollar Wrecking Ball (term from UrbanKaoBoy). The Federal Reserve signaled that monetary conditions will stay tight. Sort of the inverse of Draghi’s “whatever it takes” speech. How long will this continue? Hard to say. This may be the new regime: fiscal profligacy with above zero real rates. Or it may be that this is another financial headlock on Russia and China. Sure, the US is headed to recession but nothing near as bad as what Russia and China are headed for. Remember China is far more leveraged and leveraged to external consumption. And far worse demographics. Anyway, its entirely reasonable that if the US is willing to confiscate Russian dollars & yachts, that it can formulate a monetary policy that fights inflation and wrecks its largest competitors. I suspect it was not a plan from the outset but that the disproportionate pain that the strong dollar creates for our rivals was clear. A strong dollar typically is good for exporters, but not if the strong dollar is crushing demand via tight policy and the exporters are significanly higher leveraged than the US (although this may drag Japan down, too).

Crypto Downturn Gives Regulators More Time. Okay. I get it, kind of. No, not really. If I squint at this, it makes a little sense: more and more money coming in creates additonal opportunities for corrupt schemes. But the downturn causes the losses to become realized. Which brings us to 2 more:

Deribit raises in a down round. CCO says valuation “essentially irrelevant” because “it’s more of a clawback of dividends.” As John Adams would say, “facts are stubborn things.” If $40M was burning a hole in those investor pockets, the valuation would have been higher. It wasn’t. Deribit needed $40M so they took it. “A down round is a down round,” says Paul. And good for them for being smart enough to just do it and getting it done at any level in a bad storm.

Mashinsky Resigns. I really don’t know anything about how Celsius operated. All I can say is that he is not resigning because he wants to spend more time with the family. All I can do is wish the best to any and all caught in the maelstrom.

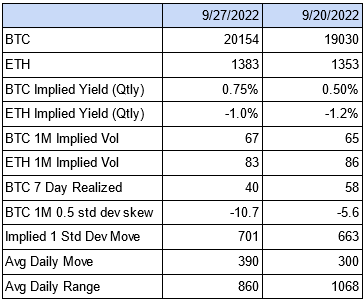

To be honest, I could have used the same meme for basis. It is just a bit stuck. The dollar is going relentlessly higher — at least for now — so I would think that there would be a bit more hedging fear out there. The real “hero” is bond market volatility (the MOVE — invented by Harley Bassman, the convexity maven).

Bottom left to top right. Meanwhile BTC has been floundering in the mid- to high- 60s. And post-merge ETH dropped into the high 70s overnight on the move up. After years of tradfi looking at their low vol markets and then longingly over at cray-cray crypto, it has now reversed. “I want to get into fixed income because it’s exciting!” The exciting things around our desk at the moment are looking at creative ways to sell skew and take advantage of the volatilty of CME basis. It is roll week for CME and there are opportunities for the nimble and the brave especially if BTC (where basis has been more directional) keeps moving. The Sep-Oct calendar spread for CME BTC had a range from -79 to -28. Entering a long Oct CME at -79 under (plus potentiall another $15 under from Sep) offers an enticing yield to hold a synthetic long BTC position rather than spot.

Things I’m reading / listening / watching / thinking about:

Rich Mackey on golf, trading and life lessons. Via John Lothian

Quant math stuff — fitting vol curves with SVI by Tim Klassen. Via Genesis Volatility. Either your eyes will light up or glaze over. This is going to be a project for me with Jack over next month or so.

Turbocharging Derivatives by Harel Jacobson.

Don’t Look Up, It’s Moloch — I don’t give near enough love to Kris & his letter. It is very clear that Kris and I see the same things in this: 1) great satire, 2) lasting lessons, 3) a <chefs kiss> performance by Mark Rylance, and 4) a visceral explanation of Moloch. “That final scene at the dinner table is disturbing and poignantly stirring at the same time.” Yeah it was.

Vernor Vinge, “A Deepness in the Sky” Full length Sci-Fi. Read rec by Agustin Lebron. I just started the audiobook.

The Tripitaka Koreana.

Tell me (how) I’m wrong,

Ari

DISCLAIMER: Do your own research. Nothing herein is investment or trading advice. All information here is given on a best efforts basis and there is no guarantee of accuracy. Digital Gamma or the author may or may not have positions in the assets or their derivatives mentioned herein.