Hi All,

So, tbh, I hate that expression. But jeez, I find it so disingenuous for commentators to talk about X or Y as an inflation hedge but ignore the dollar. Because, really, if I had told you that we would have a 9% print in CPI, I don’t think anyone’s next words would be “and so the dollar rallied hard, right?” That’s exactly what happened. So when I read Joe Weisenthal talk about “Bitcoiners trying to redefine inflation,” I … I … I just can’t (the Terminator meme is great tho). I mean it was just 2 weeks ago where Odd Lots talked about a Dollar Doom Loop because it was so strong. As I’ve said before, denominators matter — the price of BTC is in USD. USD go up, then the price of bitcoin is going to suffer. And even from just a macro viewpoint, dollar strength is an indication of increased buying power against other currencies. As a market price, it incorporates not just current inflation but the aggregated and expected set of potential future paths that lie ahead both based on markets and the policymaker reactions. Bitcoin was never a direct inflation hedge — owning “stuff” is an inflation hedge. Bitcoin is 1) a payment system and 2) like any other currency, a reciprocal (literally!) to the USD. It is just that everyone thought that inflation and dollar weakness always go together. They don’t always.

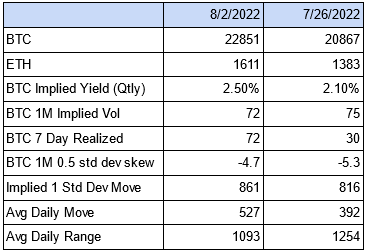

Crypto has moved on from wholesale liquidation to the ETH merge. At least I have my set of shot glasses from The TIE’s tax loss & tequila party. ETH options open interest has overtaken BTC. From the same Block article, I found this at least as interesting:

Basis for ETH remains far lower than BTC and for Dec quarterlies, is still negative, although not by much. So we have a lot of pro-ETH market action:

ETHBTC came home

ETH options open interest overtakes BTC

Put skew rapidly becoming a memory (implied volatility of calls are far closer to implieds for puts than they have been for a long time)

Upside options structures have become a “thing”

ETHE discount narrows

ETH futures basis is negative presumably as carry traders look to collect staking yields of 4% plus potential additional juice via stETH contract.

This looks like a set up for future disappointment. I don’t see anything changing in the near term here but as we get closer to the merge, my instincts are to take the other side of this. I suspect this is where the new levered carry play is and where the margin call potential lives.

Non-farm payrolls report is released this Friday. I had already been thinking that there was a potential for disappointment. With mortgage rates skyrocketing, the private construction sector can be one of the fastest reactors to interest rates. Brent Donnelly is a great twitter follow and posted this:

I am not estimating the NFP figure. I do think it is reasonable that given the price action in markets (US Treasuries, crypto, stocks, etc) that a very low print will have a disproportionate price impact. The short UST, long USD, etc one way trade has already started to crack a bit and I think that makes what is already a conventional wisdom position uncomfortable. That will become untenable on a breakdown NFP number. A negative payroll figure will, at least, have the market suspect a different path for the Fed. On the other hand, I don’t think a high number realistically changes the expected path of interest rates or positioning.

Interestingly, Aug 5 volatility which expires prior to the NFP release is price at 76-77% implied whereas Aug 12 BTC volatility which does include the NFP release, is 73-ish%. I’m liking buying gamma that 1) is lower than overnight, 2, and 3 day volatilities and 2) is already right around realized volatility. This does not seem to price in any NFP surprise. On one hand, if the expected occurs, there will be little downside. On the other hand, BTC stands to benefit as my expectation is that the dollar will get hit pretty hard. DYOR.

Meanwhile, I’m trying to work through impacts of the ETH merge on derivatives. Please reach out if you are up for discussing the potential for fractured derivatives contracts post hard fork and if there is the potential for ETH to split into 2 chains. This is not my base case, but I don’t consider myself an expert on ETH per se. Also very interesting for post-merge ETH:

The Flirting With Models podcast with Antti Ilmanen was a good one. I still need to get his second book. I’ve got Anton Katz visiting with @FintechFrank on my list as they are discussing a new regime for credit in crypto. Digital Gamma developed Tri-Party Repo a few years ago, so we are very interested in where that may go and happy to speak about it. We think its time has come.

Tell me I’m wrong (please)

Ari

DISCLAIMER: Do your own research. Nothing herein is investment or trading advice. All information here is given on a best efforts basis and there is no guarantee of accuracy. Digital Gamma or the author may or may not have positions in the assets or their derivatives mentioned herein.