The Bellatrix upgrade has been implemented and is working. This is, of course, not The Merge, but it is a key milestone. It is game on and the timing looks pretty set. You can check out the countdown on etherscan or wenmerge. Right now they differ with etherscan looking 9/15 and wenmerge suggesting 9/13. Wenright?

Obviously, I had to reference Harry Potter in this post. So it points to ETH/BTC (from TradingView) moving from the lower left to the upper right:

Without strong conviction, the above feels stretched. Buy the rumor, sell the fact-ish (see reading list below).

ETH Merge by the numbers:

There has been a lot of talk about how BTC volatility represents the value play in options vs ETH volatility. Statistically, it does. But when you are talking about event related trading, whether that is The Merge, an earnings play, or a biotech with FDA approvals pending, then you should just focus on the Thing itself. Accept no substitute. Don’t buy AUD when you want CAD. Don’t buy Intel when you want TSMC because it is “cheaper”. Know your trade and trade it. Buy BTC options because you want BTC options. Don’t buy it around the Merge event because it is showing up cheap on a relative value basis. Maybe sell it. None of the above is financial advice and none of it is a rule. At best it is, like every other piece of (potential) wisdom in the world, a guideline.

On the other hand, we can look at a post-Merge-world, more statistically-looking-like-the-long-run relationship. Say, post-Merge BTC-ETH volatility relationship. We can handwave a bit and say that BTC volatility term structure is flat at 72. And we can also handwave a bit and say that ETH volatility post-merge is falt at 102. So, stylistically speaking, the ratio is constant-ish across time at 1.4-ish (interestingly that corresponds to about the ratio that silver vol traded to gold). However, I think it is a fair thing to say that ETH options around the Merge, say 9/16 - 9/30 are far more valuable relative to BTC than those that are disconnected from the Merge, say 10/28 and longer. So, to me, a constant ratio of 1.4 does not fit. Short dates are Merge/event related. Longer term are more statistical. The short ratios should not be the same as the longer ones.

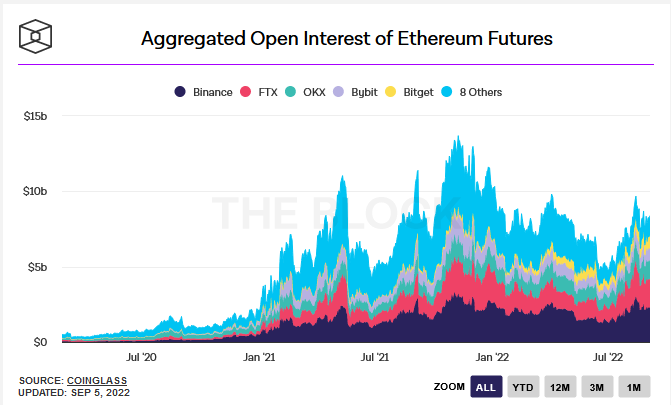

The above is from the Block’s data portal. Open interest is in USD terms so with the “low” price of ETH as compared to 2021, the open interest in ETH terms would be extremely high. People are in the futures. My belief is that this open interest revolves around the Merge (duh) and it is in place to be short futures and long spot to play for ETHW. Since the move today was an aggressive move down, the implication is that longs got liquidated and that shorts are holding tight. I don’t have data updated for Sep 6 so I can’t offer more. But once the merge occurs, and ETHW gets distributed, these shorts will need to get out. This is (part of) the vol that you came for. High open interest, high leverage, limited liquidity leads to volatility.

The ETH miners have launched the testnet for ETHW. However, I’m not seeing the foundation for long term success. I don’t yet see developers outside of a very narrow scope engaging the project. I don’t see any new stablecoins starting on the new/old chain. I’m not seeing dapps announcing. I’m not in the know here but I feel like I would see this showing up in my twitter & news feeds. And I’d see it in the price. Not a drift down in the Poloniex price. Incidentally, what happens if you trade ETHW/USDT on one of the exchanges that list it and it doesn’t happen? Is the value 0? Are you required to deliver? Do they just bust the trades?

Here is my unpopular take on Proof of Stake: I have this brand new method of crypto transaction approvals and I’m going to tell you about it. First, all of those with assets are going to get to approve transactions. And, second, as time goes on it will become increasingly expensive for users of the platform to use it. Out with the old boss and in with the new? Well, look, I know it is an unpopular opinion, but I’m not 100% onboard with the proof of stake thing. I am also acutely aware my opinion carries exactly 0 weight.

Zitti e Buono. If you wanted crypto disconnected from other risk assets, then today you got it. Chart below is intra-day from Yahoo!finance and is in UTC time.

This would be an excellent use case of the phrase “the floor fell out”. I’m not really sure what happened. What I do know is that Deribit tweeted right at that time that they were raising margins due to volatility due to the ETH Merge. Margin hikes are known position killers. All I know is that we can place the suspect proximate to the crime and there is motive. Please send along a better theory or even “the right answer”. (The Italian from Maneskin translates into “shut up and behave” which crypto most certainly did not)

Things I’m reading / interested in:

Brent Donnelly’s 50 Trades in 50 weeks. This issue — tada — is Buy The Rumor, Sell the Fact. Not only does it give a fantastic overview of the set up of such market action, but he discusses the Merge specifically. <chef’s kiss>

Michael Bentley tweeting on borrowing ETH ahead of the Merge. Needless to say, this is needlessly complicated (but oh so much more fun) due to there being no standardized language on crypto borrowing.

I saw They Call Me Rico play live in Montreal this summer at the Jazz Festival as a one man band. Fantastic. If you like your rock n roll bluesy, check it out. This Time & Preaching Blues.

Tell me (how) I’m wrong,

Ari

DISCLAIMER: Do your own research. Nothing herein is investment or trading advice. All information here is given on a best efforts basis and there is no guarantee of accuracy. Digital Gamma or the author may or may not have positions in the assets or their derivatives mentioned herein.