Hi All,

As promised, here is our fair-value framework for pricing ETH forwards post-Merge. Keep in mind that a theoretical fair value is different than a market value. Which is a) good because otherwise why trade and b) means that even if ultimately correct, there can be a wild ride. Or, as the kids say, YMMV.

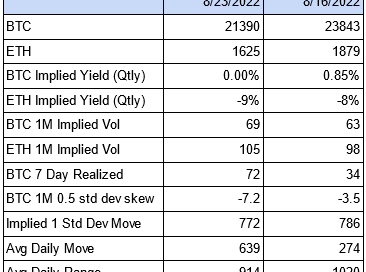

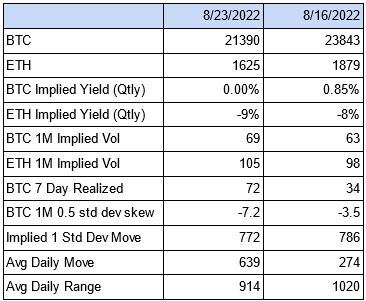

First stop: ETH Merge by the numbers:

As written in the research note, it seems odd that futures going out to March are pricing in a positive carry to be short futures when Proof-of-stake provides yield to holders of spot. For the details, of course, read the note.

It is the end of an era. Two, actually. In crypto, Genesis has undergone its post-3AC pains. The CEO, Michael Moro, and 20% of the firm are gone. Genesis has been and, likely will continue to be, a very large presence in our industry. Still, it is hard for crypto not to be, at least, little impacted by that. And the second is the passing of Julian Robertson. For those of us that have been in finance prior to Satoshi, Robertson and Tiger have been a major force. Again, hard to imagine that there is not at least a subtle change in certain areas of finance.

The Sound of Selling: Hello Dollar My Old Friend. Unsurprisingly there is weakness in most markets as financial conditions tighten — the USD index is up at the highs again after relenting. RMB devaluation causes barely a stir per Mohamed El-Erian. Is that strong dollar crushing domestic Chinese demand? More to come as Treasury issuance comes soon.

Fourth stop: stablecoins. Regulation is what it is. However, in the stablecoin world, market competition appears to have made an impact. USDC market share in light of credit risk has driven Tether toward a more responsible portfolio. If the model of a stable coin is cheap payment system in exchange for money market fund type credit risk, then ther has been a repricing of that cost/benefit. Tether has been ditching vague commercial paper in favor of T-Bills. Combined with USDC, Stablecoin issuers are a force in US debt market. For completeness, Odd Lots talks stablecoins with Jeremy Allaire.

Fifth: Deribit launches combos! Spreads are the lifeblood of options trading. Whether it involves options spreads, combining spreads with futures, or futures spreads, options traders are always looking to create profiles & manage risk. Anyway, this makes it here because 1) we are deriv tradoors and 2) I’m genuinely curious how that is going to impact Paradigm business, especially their global RFQ book (vs their all-or-none Direct RFQ book).

Basis did get interesting (again). Sep 30 BTC basis on OKX for their coin based margin product went to in excess of $100 discount to spot. It is currently around -$20 and seems more likely than not to join its friends at a small positive number. Obviously (per our note) we find ETH March futures out of line with PoS and the rest of the ETH forwards curve. Reference that document for more.

On the options front, I took a look at Sep 30 vol as it is 10 vols higher than 9/9. So a clear Merge play on volatility. Sep 9 vol is ~95% and Sep 30 ~105%. Depending on your view of Merge vol (nevermind strike choices!), then you should consider what the volatility from 9/9 to 9/30 is implied to be. Like rates, the forward implied volatility. Running the calculations give 112%. Meaning that all things being equal and following assumptions of the model, that if you bought 9/9 options and sold 9/30 options, then so long as you were able to buy back 9/30 options after 9/9 expiration under 112% implied vol, then you make money. There is a lot in there involving hedging strategy and path dependency, but that is a reasonable starting point for relative value.

Also: Here is a chunky butterfly trading on Paradigm/Deribit:

The ETH 3/31/23 3500-4000-4500 butterfly trades 0.0072 ETH (~$12). Definitely a lottery ticket play that comes in substantially cheaper than an outright call.

Things I’m reading / interested in:

Arca blog covers overblown ETH Merge fears. I liked this compendium of “my many fears” along with why they are overblown.

Lyn Alden is always a good read and here she covers Lightning Network. I’ll confess that I have not yet read it. For me, Lightning is both interesting and important. The mechanics of LN mean that it hides transaction data from the blockchain and is therefore censorship resistant. I also consider a critical aspect of BTC to be its function as a payment system so LN or something like it is important for scalability.

I want to wrap my head around this. MEV has been something I need to know more about.

Tell me I’m wrong (please)

Ari

DISCLAIMER: Do your own research. Nothing herein is investment or trading advice. All information here is given on a best efforts basis and there is no guarantee of accuracy. Digital Gamma or the author may or may not have positions in the assets or their derivatives mentioned herein.